The pattern of this crisis may be hard to predict. What is not hard to predict is that Chief Financial Officers without strong Heads of Treasury, Financial Planning & Analysis (“FP&A”) and Investor Relations are going to struggle to be as strategic as the crisis demands. Traditionally, these three roles attract technical specialists. But it is those who have a breadth of skillset that are adding value today. We share our research and insights into the implications of these challenges.

Shape of this economic crisis

The re-bound in some share prices post the recent Pfizer vaccine announcement was extraordinary, as was the fall in prices for those with strong on-line offerings. It serves to remind us that we are in unchartered territory, and that however quickly an effective vaccine is able to put this pandemic to bed, the precise impact on companies is still a lot of guess work. What we do know is this is severe. In 2009, the worst year of the financial crisis, global output dipped 0.1%. The OECD’s interim report in September predicted a drop in global growth in 2020 of 4.5%. For 2021 it predicted growth to rebound to 5%, still below 2019 levels but that depended on whether there was a resurgence of the virus. With not only a resurgence of the virus but also lockdowns in multiple countries, it would be wise to expect a bumpy ride.

Three key roles for surviving this crisis

![]()

The Head of Treasury plays a critical role in ensuring the right facilities and payment terms are in place to match numerous scenarios; no wonder so many are in board and executive committee meetings at the moment.

![]()

The Head of FP&A’s ability to harness data from within the business and turn it into powerful analysis is vital to driving informed decisions on cost control and investment.

![]()

For the Head of Investor Relations, their skill in forming the most robust narrative, to withstand heightened investor scrutiny, has never been more important to a company’s viability.

Hedley May has a deep and specialist capability in these three roles. Below we discuss the breadth of skills we see in those performing at the top of their game and analyse the market for these individuals. We also assess the opportunity to bring in diverse talent.

Head of Treasury

The best Treasurers have been ahead of the curve – they have scoped multiple scenarios, to respond quickly to any deterioration or upswing. Most Treasurers are cautious but there is missed opportunity in excess caution and the so the top tier Treasurers are incredibly open to being constructively challenged.

The Market for Talent

- Not an easy market as it is dominated by career Treasurers (approx 60%) who traditionally remain in role for 10 + years – there is a strength in experience but notice if there is excessive caution and low innovation.

- More movement over the past three years (2017 peak year with 12 appointments, 2018 10 appointments, 2019 9 appointments). In the 2020 crisis, activity has slowed with only three appointments to date.

- Out of the 21 appointments in the last three years, 11 have been internal appointments to men.

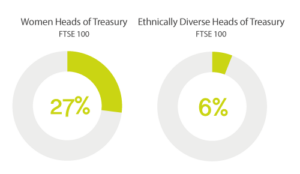

Diversity

- 27% of Treasurers are women in the FTSE 100

- 6% of Treasurers are ethnically diverse in the FTSE 100

Head of FP&A

The best FP&A leaders are proactive – always asking the next question. They also have great relationship skills and are able to call in favours from the business to obtain high-quality data and analysis. Their written and oral communication and influencing skills are critical because it is these that ensure their analysis translates into actual decision making.

The Market for Talent

- As a result of the demands of this blended skill set, fewer traditional accountants will be appropriate. And fewer than 50% of external FP&A hires came directly out of an FP&A role.

- We also note the trend for appointing talent from outside of the FTSE, perhaps related to the fast paced changes in data analytics. For example, Diageo appointed from Rémy Cointreau, Experian from Expedia and Informa from Liberty Global.

- Over 50% of appointments are internal, on account of the importance of relationships to getting hold of data combined with a pre-existing understanding of the business.

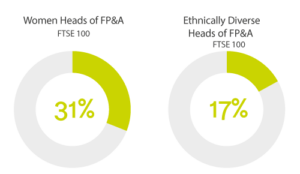

Diversity

- 31% of Heads of FP&A are women in the FTSE 100

- 17% of Heads of FP&A are ethnically diverse in the FTSE 100

Head of Investor Relations

The best Heads of IR have outstanding communication skills and are on the front foot at either exciting or reassuring investors and analysts. Not only does this reduce time pressure on the CEO and CFO, it enables them to keep focused on the strategic challenges and opportunities. This tripartite relationship needs to be constructively critical, so that any groupthink is infused with external insights. The narrative around the ESG agenda is a growing challenge for IR heads too. Not all will be able to adapt to these new demands.

The Market for Talent

- The ability to bring in high quality individuals from the ‘sell’ side makes this an easier market – the role lands well with this community.

- The most interesting talent already in-house tends to be found in companies that have complex investor stories.

- PLC experience is favourable on account of governance requirements, although searching broadly and looking beyond the FTSE at sector related companies can widen the pool.

- Appointments tend to be dominated by external hires. In companies of scale, however, there is the opportunity to rotate high potentials through the function, providing succession options.

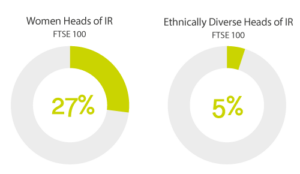

Diversity

- 27% of Heads of IR are women in the FTSE 100

- 5% of Heads of IR are ethnically diverse in the FTSE 100

Conclusion

The crisis is uncovering those who make a real difference. These individuals are not always easy to identify but they do exist and also provide an opportunity to increase diversity in the finance function.